EVANSVILLE, INDIANA, November 5, 2010 – Berry Plastics Corporation ("Berry"), an Apollo Management, L.P. and Graham Partners portfolio company, announced today the launch on November 4, 2010 of cash tender offers and consent solicitations with respect to any and all of its outstanding 8⅞% Second Priority Senior Secured Fixed Rate Notes due 2014 issued under an indenture dated as of September 20, 2006 (the "2006 Notes") and any and all of its outstanding 8⅞% Second Priority Senior Secured Notes due 2014 issued under an indenture dated as of November 12, 2009 (the "2009 Notes", and, together with the 2006 Notes, the "Notes").

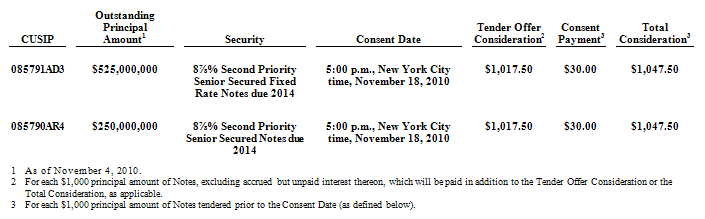

The Notes and other information relative to the tender offers and consent solicitations are set forth in the table below.

In connection with the tender offers, Berry is soliciting the consents of the holders of the Notes to proposed amendments to each indenture governing each series of Notes (the "Proposed Amendments"). The principal purpose of the consent solicitations and the Proposed Amendments is to eliminate substantially all of the restrictive covenants, eliminate or modify certain events of default and eliminate or modify related provisions contained in the indentures governing the Notes. In order for the Proposed Amendments to be effective with respect to an applicable series of Notes, holders of at least a majority of the outstanding aggregate principal amount of such series of Notes must consent to the Proposed Amendments. Holders who tender Notes are obligated to consent to the Proposed Amendments and holders may not deliver consents without tendering the related Notes.

Each holder who validly tenders its Notes and delivers consents to the Proposed Amendments prior to 5:00 p.m., New York City time, on November 18, 2010, unless such time is extended by Berry (the "Consent Date"), will receive, if such Notes are accepted for purchase pursuant to the tender offers, the total consideration of $1,047.50, which includes $1,017.50 as the tender offer consideration and $30.00 as a consent payment. In addition, accrued interest up to, but not including, the applicable payment date of the Notes will be paid in cash on all validly tendered and accepted Notes.

The tender offers are scheduled to expire at 12:00 midnight, New York City time, on December 3, 2010, unless extended (the "Expiration Date"). Tendered Notes may be withdrawn and consents may be revoked at any time prior to the Consent Date but not thereafter. Holders who validly tender their Notes and deliver their consents after the Consent Date will receive only the tender offer consideration and will not be entitled to receive a consent payment if such Notes are accepted for purchase pursuant to the tender offers.

Berry reserves the right, at any time or times following the Consent Date but prior to the Expiration Date, to accept for purchase all the 2006 Notes (such time, the "2006 Notes Early Acceptance Time") and/or the 2009 Notes (such time, the "2009 Notes Early Acceptance Time" and together with the 2006 Notes Early Acceptance Time, the "Applicable Early Acceptance Time"), validly tendered prior to the Applicable Early Acceptance Time. If Berry elects to exercise this option, it will pay the total consideration for the 2006 Notes and/or the 2009 Notes accepted for purchase at the Applicable Early Acceptance Time on such date or dates (each such date, the "Applicable Early Payment Date") promptly following the Applicable Early Acceptance Time. Also on the Applicable Early Payment Date, Berry will pay accrued and unpaid interest up to, but not including, the Applicable Early Payment Date on the Notes accepted for purchase at the Applicable Early Acceptance Time. Berry currently expects that the Applicable Early Payment Date will be November 19, 2010.

Subject to the terms and conditions of the tender offers and the consent solicitations, Berry will, at such time or times after the Expiration Date, accept for purchase all the 2006 Notes (such time, the "2006 Notes Final Acceptance Time") and/or the 2009 Notes (such time, the "2009 Notes Final Acceptance Time", and together with the 2006 Notes Final Acceptance Time, the "Applicable Final Acceptance Time"), validly tendered prior to the Expiration Date (or if Berry has exercised its early purchase option described above, all the 2006 Notes and/or the 2009 Notes, as applicable, validly tendered after the Applicable Early Acceptance Time and prior to the Expiration Date). Berry will pay the total consideration or tender offer consideration, as the case may be, for the 2006 Notes and/or the 2009 Notes accepted for purchase at the Applicable Final Acceptance Time on such date or dates (each such date, the "Applicable Final Payment Date") promptly following the Applicable Final Acceptance Time. Also on the Applicable Final Payment Date, Berry will pay accrued and unpaid interest up to, but not including, the Applicable Final Payment Date on the Notes accepted for purchase at the Applicable Final Acceptance Time. Berry currently expects that the Applicable Final Payment Date will be December 6, 2010. The consummation of the tender offers and the consent solicitations is conditioned upon, among other things, (i) the issuance of an aggregate principal amount of new second priority senior secured notes acceptable to Berry in its sole discretion, with terms (including economic terms) acceptable to Berry in its sole discretion, to permit the closing of the tender offers, consent solicitations, the redemption of the Notes, if required, and related transactions, and the availability of proceeds from the issuance of the new notes necessary to pay the applicable total consideration and interest to the Applicable Early Payment Date or the Applicable Final Payment Date, as the case may be, for validly tendered notes and/or redeem Notes, if required (including any applicable premiums and fees and expenses) and (ii) the receipt of the consents of holders of at least a majority of the outstanding aggregate principal amount of each of the 2006 Notes and the 2009 Notes to the applicable Proposed Amendments, and the execution of the applicable supplemental indenture giving effect to the Proposed Amendments.

If any of the conditions are not satisfied, Berry may terminate the tender offers and return tendered Notes. Berry has the right to waive any of the foregoing conditions with respect to the Notes of any or all series and to consummate any or all of the tender offers and the consent solicitations. In addition, Berry has the right, in its sole discretion, to terminate the tender offers and/or the consent solicitations at any time, subject to applicable law.

This announcement shall not constitute an offer to purchase or a solicitation of an offer to sell any securities. The complete terms and conditions of the tender offers and consent solicitations are set forth in an Offer to Purchase and Consent Solicitation Statement dated November 4, 2010 and the related Consent and Letter of Transmittal (the “Offer Documents”) that are being sent to holders of the Notes. The tender offers and consent solicitations are being made only through, and subject to the terms and conditions set forth in, the Offer Documents and related materials.

Credit Suisse Securities (USA) LLC will act as Dealer Manager and Solicitation Agent for the tender offers and consent solicitations. Questions regarding the tender offers or consent solicitations may be directed to Credit Suisse Securities (USA) LLC at (800) 820-1653 (toll-free) or at (212) 538-2147 (collect).

Global Bondholder Services Corporation will act as the Information Agent for the tender offers and consent solicitations. Requests for the Offer Documents may be directed to Global Bondholder Services Corporation at 212-430-3774 (for brokers and banks) or (866) 795-2200 (for all others).

Neither Berry's board of directors nor any other person makes any recommendation as to whether holders of Notes should tender their Notes or provide the related consents, and no one has been authorized to make such a recommendation. Holders of Notes must make their own decisions as to whether to tender their Notes and provide the related consents, and if they decide to do so, the principal amount of the Notes to tender. Holders of the Notes should read carefully the Offer Documents and related materials before any decision is made with respect to the tender offers and consent solicitations.

For additional information, please contact:

James M. Kratochvil

Executive Vice President and Chief Financial Officer

Diane Tungate

Executive Assistant

Berry Plastics Corporation

101 Oakley Street

Evansville, IN 47710

Telephone: (812) 424-2904

About Berry Plastics

Berry Plastics isa leading manufacturer and marketer of plastic packaging products. BerryPlastics is a major producer of a wide range of products, including open topand closed top packaging, polyethylene and PVC based plastic films, industrialtapes, medical specialties, packaging, heat-shrinkable coatings, specialtylaminates, and FIBCs. The company's 13,000 plus customers range from largemultinational corporations to small local businesses. Based in Evansville,Indiana, the company over 75 manufacturing facilities worldwide and over 16,000employees.

# # #

Certain statements and information included in this release may constitute "forward looking statements" within the meaning of the Federal Private Securities Litigation Reform Act of 1995. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance, or achievements of Berry Plastics to be materially different from any future results, performance, or achievements expressed or implied in such forward looking statements. Additional discussion of factors that could cause actual results to differ materially from management's projections, forecasts, estimates and expectations is contained in the company's SEC filings. The company does not undertake any obligation to update any forward-looking statements, or to make any other forward-looking statements, whether as a result of new information, future events or otherwise.